The erythritol market is projected to grow significantly, expanding from USD 261.2 million in 2025 to USD 544.5 million by 2035, witnessing a CAGR of 7.6% through the forecast period. Growing consumer preferences for natural sugar alternatives, clean-label foods and low-calorie sweeteners are major drivers that are been expected to drive the industry growth.

Natural sugar alcohol erythritol is gaining popularity due to zero calorie value, extremely low glycaemic effect, and no harmful effect on teeth. Excessive regulatory moves to restrict applications of sugar for food products and beverages in North America, Europe, and Asia also are speeding its use at most food applications. It is part of the standard in sugar-free and low-sugar foods and thus will be the key ingredient in the new functional foods and beverages and dietary supplements.

Growing concern over possible health threats from overconsumption of sugar - obesity and diabetes, to name two - has led manufacturers to reformulate products that include erythritol. The molecule's ability to replicate the flavour and texture of sugar with no caloric value means it's well-suited for inclusion in confectionery, dairy and ketogenic foods.

This is complemented by advancements in its fermentation-based manufacture which can also reduce costs and dependency on conventional cornstarch technologies, thereby further supporting sustainability. The growing popularity of the low-carb, keto, and diabetic diet is one of the major factors stimulating the industry. Unlike maltitol and xylitol, it doesn't spike blood glucose levels, making it the perfect sweetener for diabetic consumers as well as ketogenic and paleo food users.

It’s also used in the sports nutrition industry to sweeten protein bars, electrolyte drinks and meal replacements without adding extra carbs. North American (not as much Canadian) is at the lead; the United States products are especially driven, where food and drink products are predicted to be keto-trending and presumably already through the boom.

That said, there is room for growth, but the industry is restrained by unstable prices, availability of raw materials, and, in some cases, digestive issues from overindulging. This issue with regulatory authorities is compounded by the consumer insensitivity toward occasional reports of gastrointestinal distress, which will smother any further popularization.

It also competes with other sweeteners such as allulose, monk fruit, and stevia, and manufacturers must spend money on promotion and product differentiation. That, paired with the new food trend of cleaner-labelling and being more mindful of what they’re putting into their bodies works well with erythritol-based products. To address this challenge, companies search for new formulations with product with other natural sweeteners to enhance flavour profiles and drive consumer acceptance.

Sustainability factors are a trend in the industry by achieving circular economy in production processes and bio-based fermentation.

If one keeps investing in R&D to meet the evolving consumer demand for healthy but sustainable food culture consumption, theys will still be a game-changer in the sugar substitute inner.

| Attributes | Description |

|---|---|

| Industry Size (2025E) | USD 261.2 million |

| Industry Value (2035F) | USD 544.5 million |

| CAGR (2025 to 2035) | 7.6% |

Explore FMI!

Book a free demo

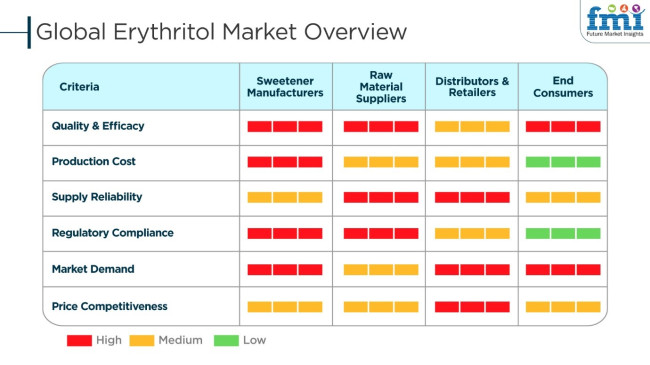

The industry is growing with high demand for low-calorie, natural, and sugar-free food and beverage ingredients. Producers of sweeteners focus on the production of high-purity product due to growing demands from health-conscious consumers and diabetics. Raw material producers are concerned with cost-effective and efficient fermentation processes in an effort to create a stable supply chain.

Retailers and distributors emphasize price competitiveness, availability of products, and compliance with food safety standards as consumers migrate toward clean-label and non-GMO sweeteners. Zero-calorie and low-glycemic product is desired by end-consumers for its properties that make it an excellent choice for ketogenic, diabetic, and weight management diets.

The industry is also fueled by trends like functional food, plant-based ingredients, and increasing popularity of confectionery, beverages, and bakery products free from sugar. As people's awareness of their health keeps growing, industry penetration of product is likely to improve, making it a prominent contributor to the worldwide sugar substitutes industry.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Industry.

This analysis reveals crucial shifts in industry performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the industry growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 7.1% (2024 to 2034) |

| H2 2024 | 7.5% (2024 to 2034) |

| H1 2025 | 7.6% (2025 to 2035) |

| H2 2025 | 7.9% (2025 to 2035) |

The above table presents the expected CAGR for the industry demand space over a semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to grow at a CAGR of 7.1%, followed by a slightly higher growth rate of 7.5% in the second half (H2) of the same year.

Moving into 2025, the CAGR is projected to increase slightly to 7.6% in the first half and remain relatively moderate at 7.9% in the second half. In the first half (H1 2025), the industry witnessed an increase of 5 BPS, while in the second half (H2 2025), the industry observed a rise of 4 BPS, indicating a steady growth pattern across the forecast period.

The industry’s sales have been growing at a CAGR of 6.8% during 2020 to 2024. In the future ten years (2025 to 2035), the expenditure on it is expected to grow at a CAGR of 7.6% due to rising demand for natural sweetener substitutes, growing applications in functional drinks, and the development of fermentation-based production processes.

The industry experienced uniform growth from 2020 through 2024, fueled by the growing interest of consumers towards sugar-free and low-calorie sweeteners following rising health scares regarding obesity, diabetes, and metabolic disorders. It attained extensive use among the food and beverage sector across confectionary, bakery goods, and milk substitutes during the said years.

Also, the low-carb and keto diet trend helped fuel its usage, as companies used it as a clean-label sugar replacement.

The industry was also impacted by supply chain losses because of the COVID-19 pandemic, resulting in changes in its production and distribution. The reliance on corn fermentation to produce it resulted in price volatility of raw materials, impacting profitability for major producers.

Despite all this, the industry held a CAGR of around 6.8% between 2020 and 2024, where North America and Europe were at the forefront of demand owing to robust support from regulations on sugar reduction programs.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for it as a natural sweetener in reduced-calorie and sugar-free foods | Growth in applications fueled by increasing interest in metabolic well-being, diabetes control, and clean-label products |

| Preeminent application in beverages, confectionery, and bakery markets as a sugar substitute | Increased use in plant-based, functional foods, and nutraceuticals owing to changing dietary patterns |

| North America and Europe as prime industries because of robust regulatory approvals and customer demand for sugar substitutes | Asia-Pacific and Latin America rapid growth driven by growing health consciousness and government efforts to reduce sugar intake |

| Relative consumer awareness regarding its advantages and safety versus other sugar alcohols | Greater consumer confidence with greater scientific proof, regulatory endorsement, and mass industry product inclusion |

| Supply chain issues from low production capacity and reliance on corn-based fermentation | Increased production scalability through raw material diversification, improved fermentation technology, and substitute feedstocks |

| Regulatory attention on sugar alcohol labeling and claims in packaged foods | Harsher global regulations on labeling that prioritize transparency, sustainability, and health impact disclosures |

| Growing industry interest in combining it with other sweeteners for flavor and functional performance | Formulation techniques combining it with new plant-based sweeteners to maximize sensory and health benefits |

The industry is subject to a plethora of risk factors such as lack of supply fo raw materials, confronting regulation problems, fluctuations in prices, competition, and consumer behavior changes that can be due to different factors.

The product production line is heavily influenced by raw material supply constraints as it is most commonly made by fermenting corn or wheat glucose. Breakdowns in the agricultural supply chain, erratic weather, and geopolitical problems can thus result in raw materials coming in less, which leads to costlier production.

Regulatory difficulties stem from the fact that there are different global standards for sugar substitutes. It is found to be safe by entities such as the FDA (USA), EFSA (Europe) and JECFA (WHO/FAO) but certain regions have some quite tough labeling and health claim rules. It is a possibility that studies establishing a cause-and-effect relationship between the intake of it and the development of a chronic illness might also influence consumers' beliefs and consequently affect sales.

Another problem is the price fluctuation that is driven by the cost of corn and wheat, the fermentation process, and energy bills. The demand for naturally sourced and non-GMO sweeteners that's on the rise also has an effect on pricing strategies.

Consumer behavior is another aspect of great importance. In spite of the fact that the arguments in Favor of the low-calorie and keto-friendly sweeteners are far more effective, the negative attitude of the consumers towards synthetic sweeteners and processed sugar alternatives could be a problem with the growth of the industry.

To create and maintain a strong demand for their product, the brands feel the need to constantly inform the consumers about its safety, advantages, and uses.

Powdered erythritol has a 53.6% share of the global industry and is increasingly being used in precision nutrition and high-performance supplements. It has better solubility, stability, and metabolically neutral properties than those common sugar compounds. Allowing food and dietary product manufacturers to use it as a key ingredient in protein blends, prebiotic fiber powders, and collagen-enriched formulations.

Demand for personalized wellness solutions has accelerated innovation in powdered product blends, which are often paired with plant-based proteins, adaptogens, and digestive enzymes to enhance their efficacy. To include formulations for diabetics, people on ketogenic diets, and fitness fanatics: expanding its portfolios of Cargill, Archer Daniels Midland (ADM) Co., and Tate & Lane.

Sports nutrition brands are joining dietary supplement manufacturers in using ultra-fine powdered product to help them formulate sugar-free offerings with smoother-mixing properties. E-commerce is clothing DIY nutrition trends, and it has gained traction among bio-hacking groups and health-oriented consumers.

Rising demand for service-based personalized nutrition solutions will make it one of the highly sought functional foods and supplements products.

The second-largest sugar alternative in functional foods, baked goods, and reduced-calorie sweetener mixes, granular product captures a industry share of 46.4% Granular variants provide a sugar such as mouthfeel and dissolution profile that highs in low glycaemia baked goods, chewy and vegan cream cheese.

As consumer demand for clean-label, low-calorie products rises, food manufacturers are increasingly turning to it, which can be added to packaged snacks, protein bars and artisan chocolate to boost sweetness without sacrificing digestive tolerance and blood sugar balance. Larger brands such as Cargill, Jungbunzlauer, and Tate & Lyle are developing their own non-GMO, crystalline product to be a better fit for health-minded consumers and keto-friendly products.

Growth of home baking and homemade sugar alternatives via e-commerce platforms are also likely to drive the demand for bulk and retail-sourced granular product. It is likely to make inroads across the premium, natural, and functional food space as the marketplace shifts towards metabolic-appropriate, science-based sugar alternatives.

With lines in next-gen hydration, functional herbal infusions, and cognitive performance drinks, erythritol claims a 35.6% share of the global beverage sweeteners industry. It offers an overall cleaner and more natural sweetness than other sugar alcohols that may leave unsavory after tones and fit smoothie needs, as well as low-glycaemic electrolytes and sugar-free sports recovery formulas.

A major growth driver is increasing demand for advanced hydration solutions, from electrolyte-infused waters with brain-boosting nootropics to adaptogenic herbal teas - both requiring a gut-friendly, neutral sweetener. It is being included in functional beverage lines of companies like PepsiCo, Nestlé, and The Coca-Cola Company to target diabetic-friendly and endurance-performance audiences.

It is also gaining traction in the pharmaceutical sector and has an acquisition of 28.4% industry share owing to increasing demand from drug manufacturers for safer, non-cariogenic excipients in medication, chewable tablets, and oral suspensions. But unlike other sugar-based binders, it provides stability, low-calorie content, and digestible tolerance, making it suitable for diabetic-friendly formulations and pediatric medications.

It is also being incorporated into cough syrups, lozenges, and probiotic supplements and tablets by pharmaceutical companies, like Pfizer, Bayer, and GlaxoSmithKline, to improve patient compliance. Furthermore, it is non-fermentable, making it an appealing ingredient for dental health foods such as fluoride tablets and medicated gums for the protection of tooth decay.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

| China | 7.5% |

| Germany | 4.1% |

| India | 5.3% |

| Japan | 3.9% |

The USA is at the forefront of the world industry with a growing demand for functional beverages, wellness shots, and ready-to-drink healthy drinks. Consumers are drawn to clean-label, non-GMO alternative sweeteners, prompting manufacturers to develop low-glycemic sweetened sports electrolyte beverages, nootropics drinks, and plant-based milk alternatives. Increased focus on metabolic well-being and biohacking has also driven the adoption of sports nutrition and improved hydration beverages.

Regulatory issues related to artificial sweeteners like aspartame and sucralose have prompted manufacturers to shift towards erythritol-based alternatives. Large players invest heavily in fermentation-based manufacturing, increasing availability and affordability in food service and retail channels. Increased product innovation, retail growth, and health-oriented consumption are all set to keep the USA industry at the top. FMI believes the USA industry will grow at 6.2% CAGR throughout the study.

Growth Factors in the USA

| Key Drivers | Description |

|---|---|

| Functional Beverage Growth | Larger use of energy and electrolyte drinks. |

| Regulatory Shift | More regulation of artificial sweeteners accelerates substitution. |

| Clean-Label Demand | Consumers switch to non-GMO, natural offerings. |

| Investment in Fermentation Technology | Companies maximize efficiency and cost savings in production. |

Germany's market is growing with high-end confectionery companies and artisan bakeries that promote low-calorie and sugar-free indulgence. While mass-market formulations use it differently, the sugar substitute gains greater acceptance in gourmet pastries, hand-made chocolates, and specialty bakery items, signifying the nation's rich artisan food culture.

European consumers, especially German consumers, are looking for sugar substitutes that are neutral in taste and texture and provide health benefits. This has led to the creation of gluten-free, diabetic-friendly, and clean-label desserts. Online gourmet websites and specialty retail bakeries are at the forefront of bringing alternatives to conventional sweeteners, supporting their premium positioning.

Government policies for lower sugar levels in processed foods further facilitate adoption for independent food service operators and bakeries. Investment in technology related to sugar reduction and tailored formulation is defining long-term trends for growth. FMI discovers that Germany will grow at a 4.1% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Description |

|---|---|

| Artisan Bakery Demand | Greater use in homemade pastries and chocolate. |

| Consumer Preference for Natural Sweeteners | There is a strong demand for products comparable to natural flavor and texture. |

| Government Policies Placing Brakes on Sugar | Regulations stimulate the move to healthier alternatives. |

| Specialty Retail & Online Development | Gourmet channel expansion improves availability. |

China's industry is growing into non-food and beverage uses for the industry, with Traditional Chinese Medicine (TCM) and herbal nutraceuticals featuring it as a sugar substitute. Herbal teas, botanical-infused tonics, and functional supplement powders increasingly turn to low-calorie alternatives that add palatability without sacrificing medicinal properties.

Sweeteners are increasingly employed in ginseng-based drinks, goji-infused tonics, and herbal supplement blends, indicative of China's embracement of functional nutrition in the form of new alternatives. With urban consumers hungry for TCM-enhanced health drinks, their application in developing herbal products is widening.

Government-sponsored food safety and sugar reduction initiatives prioritize upscaling in mass food and beverage companies. Domestic producers invest in fermentation-based manufacturing, improving cost and supply efficiency. China will be an emerging global supplier and consumer by 2035. FMI projects that the China industry will likely grow at 7.5% CAGR throughout the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| TCM and Herbal Integration | Adoption of traditional and herbal products. |

| Government Support | Policies for sugar reduction drive adoption in food and beverage industries. |

| Increased Urban Consumer Base | Rising demand for functional wellness drinks. |

| Domestic Supply | Investments in fermentation technology enhance availability and cost. |

India's industry is growing with changing consumer trends towards sugar-free milk, low-calorie sweets, and functional packaged snacks. Urbanization, rising disposable incomes, and increasing health awareness have driven demand for flavored yogurts, protein bars, and diabetic sweets.

India's government's strategy for nutrition fortification and sugar reduction in packaged foods forces food companies to adopt erythritol-based formulations in mass product development. Large dairy and snack food companies are introducing healthier versions of traditional Indian sweets to cater to health-conscious consumers. With huge local production and distribution growth, the industry will likely see phenomenal growth.

FMI predicts India's industry to grow at a 5.3% CAGR over the study period.

Growth Factors in India

| Key Drivers | Description |

|---|---|

| Urban Wellness Trends | Growth in demand for low-calorie dairy and snacks. |

| Government Sugar Reduction Policies | Foster consumption of packaged foods. |

| Growth in Local Dairy Industry | Increased consumption in traditional and modern dairy uses. |

| Expansion in E-commerce Distribution | Online availability expands industry access. |

The Japanese industry is changing with the rising use of high-end functional beverages, sugar-free confectionery, and high-end nutritional. Consumers in Japan demand high-quality, well-studied sugar substitutes; thus, they are the first choice for high-end health-oriented applications.

Japan is dependent on imported American and European erythritol, a high-end priced ingredient in most health foods. Despite that, local producers are going for fermentation technology to take local production to the high end and decrease dependence on imports. Demand from growing specialty health stores and pharmacy-led distribution channels that induce health-conscious food manufacturing at the point of sale also boost industry demand.

As growing consumer demand for low-calorie, clean-label foods propels Japan's dynamic food and beverage industry, natural sweeteners are assuming the limelight.

Growth Factors in Japan

| Key Drivers | Detail |

|---|---|

| Premium Health Products | Used as an ingredient in premium nutritional products. |

| Reliance on Imports | Imported mainly from Europe and the USA |

| Functional Drink Growth | Sugar-free beverages boost demand. |

| Investment in Domestic Production | Multi-sided fermentation technology aims at diversification from external inputs. |

The industry is on a knock boom, meeting new demands for sugar alternatives across food, beverage, and pharmaceutical verticals. It transforms such factors as the changing consumer perceptions toward low-calorie, naturally sweet diets as well as regulatory impetus for sugar reduction initiatives. Companies focus on sustainability in production, large-scale fermentation processes, and new formulation technologies that boost product functionality and reach.

The industry is mainly driven by dominant players, including Cargill Incorporated, Archer Daniels Midland (ADM), and Jungbunzlauer Suisse AG, through huge manufacturing facilities, supply chain integration toward consumers, and strong partnerships with the food and beverage sector. These companies are focused more on producing non-GMO, organic, and purity-defined formulations of it to meet current consumer preferences.

Custom-made blends are proving attractive for start-ups and niche players, plus they are addressing bioengineered solutions for improved taste and performance. Sustainability and operational efficiency will be key issues, with companies increasingly investing in state-of-the-art technology for carbon-neutral processes and fermentation processes.

As industry convergence speeds up, the competitive edge will be with firms that emphasize innovation, compliance with regulations, and strategic alliances.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill Incorporated | 30-35% |

| Archer Daniels Midland (ADM) | 20-25% |

| Jungbunzlauer Suisse AG | 10-15% |

| Shandong Sanyuan Biotechnology Co., Ltd. | 5-10% |

| Zhucheng Dongxiao Biotechnology Co., Ltd. | 5-8% |

| Other Players | 10-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill Incorporated | Industry leader with large-scale fermentation-based erythritol production and strong partnerships with food manufacturers. |

| Archer Daniels Midland (ADM) | Focuses on sustainable erythritol production and customized formulations for health-conscious consumers. |

| Jungbunzlauer Suisse AG | Specializes in high-purity, non-GMO erythritol, catering to clean-label and organic food markets. |

| Shandong Sanyuan Biotechnology Co., Ltd. | Expanding market reach through cost-effective erythritol production for bulk supply. |

| Zhucheng Dongxiao Biotechnology Co., Ltd. | Leading Chinese supplier, focusing on erythritol for functional food and beverage applications. |

Key Company Insights

Cargill Incorporated (30-35%)

In the forefront with a strong global distribution, making advanced use of fermentation technology for the production of it on a large scale.

Archer Daniels Midland (ADM) (20-25%)

Innovative developer for sugar alternatives focusing attention on sustainable, biotechnological solutions for it.

Jungbunzlauer Suisse AG 10-15%

Trendsetting leader in clean label innovations, well-known for their highly purified erythritol.

Shandong Sanyuan Biotechnology Co., Ltd. (5-10%)

The production of it is growing fast with inexpensive and efficient means of bulk supply.

Zhucheng Dongxiao Biotechnology Co., Ltd. (5-8%)

An all-rounder in China, where its applications are for functional and impractical foods and beverages.

Other Key Players (10-25% Combined)

The industry is slated to reach USD 261.2 million in 2025.

The industry is predicted to reach a size of USD 544.5 million by 2035.

The key players in the industry include Cargill Incorporated, Archer Daniels Midland (ADM), Jungbunzlauer Suisse AG, Shandong Sanyuan Biotechnology Co., Ltd., Zhucheng Dongxiao Biotechnology Co., Ltd., Baolingbao Biology Co., Ltd., Zhucheng Xingmao Corn Developing Co., Ltd., Mitsubishi Corporation, ProAgro GmbH, and Buxtrade GmbH.

China, slated to grow at 7.5% CAGR during the study period, is poised for fastest growth.

Powdered form is being widely used.

By form, the market is segmented into powder and granular.

By application, the market is segmented into beverages, pharmaceuticals, cosmetics, bakery and confectionery, dairy, and other applications.

By region, the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Egg Protein Market Insights – High-Protein Nutrition & Market Growth 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Egg Substitute Market Insights – Plant-Based Alternatives & Industry Growth 2025 to 2035

Egg-Free Dressing Market Trends – Growth & Innovation 2025 to 2035

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.